2025 Q3 Market Report

I just reread my Q2 report, and boy is it tempting to just resend that 😊. Not a lot has changed.

The quant/tech job market in finance isn’t dead. In fact, we are working on quite a few very interesting opportunities. However, the market is very challenging. It’s a buyers’ market, and companies are holding out for individuals who exactly meet their requirements. If you’re looking for your next job, your search is likely to take significantly longer than the last time you hit the pavement. And in this market, only a select few have leverage when it comes to compensation. Specifically, unless you’re getting offers at multiple top paying firms, expect to be flat or even down.

It's interesting to observe the steady migration of brilliant people to Anthropic/OpenAI/Google DeepMind/Etc. (See 7 things HFT quants need to know about OpenAI before accepting a $3m job offer). I regularly see more and more of the true superstars I’ve worked with show up on LinkedIn under one of these names. Jason Dibble, of Curatia, wrote recently, “OpenAI and rival tech companies have increasingly dangled stratospheric pay packages for AI gurus in the intensifying race to reach artificial general intelligence. Meta, playing catchup in that contest, reportedly offered one senior AI talent at the startup of former OpenAI CTO Mira Murati a contract worth as much as $1.5B over six years. Yes, really.”

Dibble also writes, “Firms are hiring fewer traders and technologists but paying them more, discouraging job-hopping. They’re also attaching more conditions to paydays through noncompetes and discretionary bonus structures with deferrals and clawbacks. Such arrangements boost the allure of proven firms with diversified trading strategies.”

This phenomenon is one of the key drivers of this challenging market. There are open jobs, they pay well, but there are far fewer openings compared to just a couple of years ago, and the bar is high. If you’re hiring, it can still be hard to find great people, because the good ones are likely well-paid and not looking to move so quickly in a market that has changed so rapidly and is hard to predict.

The Market in Pictures

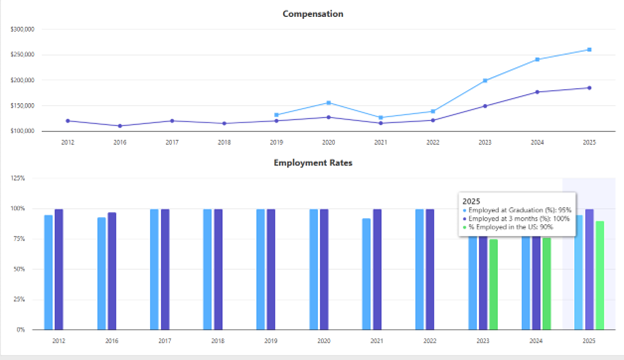

Many of you probably know Quantnet, a fantastic site dedicated to careers in Quantitative Finance and Financial Engineering. The site ranks university programs and tracks employment rates of graduates from the various programs. Below is the chart for NYU. The chart clearly shows the trends outlined above, with fewer NYU grads employed both at graduation and 3 months post-graduation, coupled with lower average salaries. The chart also shows the post-Covid hiring bubble when compensation spiked unsustainably.

NYU

Below is Princeton’s chart, the top ranked program. Here we see that Princeton grads are having only a slightly harder time finding employment now compared to the past few years, and salaries continue to rise: Top grads are still in demand and commanding a premium.

PRINCETON

Advice for College Students

The message from those newly entering the work force is consistent – it’s very hard to find that first job regardless of the field you’re in, even computer science. Some thoughts for those refining their skills in college (and beyond):

Problem solving/critical thinking are as important as ever

High-level thinking can’t be handed off

Be as AI aware as possible (note 11,000 Accenture layoffs – those deemed not trainable in AI)

Know the tools - How are they used? Where do they work and where not?

Become proficient as a user of AI – prompt engineering, etc.

If you are going to be a software engineer, focus on the fundamentals – no shortcuts

Don’t expect that you don’t need to know the low-level details because most of the code is now AI generated

Embrace the Boring

John Ameachi is an ex-NBA player, more renowned for his work in the field of Leadership than his time in the NBA. He recently had a conversation with Tyler Cowen, famous economist and host of the podcast Conversations with Tyler. Ameachi is very insightful, and I highly recommend this interview. He was asked how marginal NBA talent performs in the real world after basketball, and I thought his answer was instructive: “it helps if you’ve got a bachelor’s degree… I should have said this first, more importantly than that, if you played professional sport, you’ve learned to embrace and even love mundanity, the boring, the repetitive. And if you can embrace the boring and the repetitive, there is no job you can’t be good at.”

The interview process in our field is heavily tilted towards assessing candidates’ intellect. Leetcode, problem solving, brain teasers – we all know what this gamut looks like. These interviews are hard and very few people have the ability to pass them. But ultimately, truly successful people have both the intellect to pass these interviews coupled with the ability to slog through a lot of crap.

Compute Exchange Follow up

Last quarter I mentioned Compute.Exchange, a market for Compute, started by Don Wilson and others. Don was on the Bloomberg Odd Lots podcast recently, and it was a good listen. Amazing factoid from the podcast: The market for compute will surpass the size of the oil market ($6 trillion 2024) next year! I suppose this isn’t surprising given the hundreds of billions of dollars being spent on data centers, but it’s certainly eye opening.

On The Chain

More from Don Wilson – he predicts that all securities will be tokenized (traded on a blockchain) within 5 years. He did warn that he is usually overly aggressive predicting these things. However, the SEC announced Project Crypto in August, an initiative to modernize securities rules and regulations to allow for crypto-based trading.

I mentioned 2 years ago that “DeFi remains a good career bet.” I believe this continues to be the case. Quoting one of our client’s founders, “We are entering a decade of blockchain based financial innovation.” I for one, am curious to see where it goes. Note the first opportunity listed below – some of my fascination and conviction in DeFi stems from working with this client.

Current Priorities

SE: Software Engineer

QD: Quantitative Developer

QR: Quantitative Researcher

HF: Hedge Fund

FinTech

Founding Engineer - Low-latency, low-level SE – New L1 Blockchain

This is a special opportunity to be a significant part of a potential seismic shift of the crypto/blockchain universe. Yes, that sounds hyperbolic! - but this is one of the highest leverage opportunities you’ll find.

Blockchain Architect – In-depth knowledge of electronic exchanges

Generative AI Specialist

Senior Python SE Senior Data & AI

Buy Side

Data Scientist – Market Intelligence team

Senior Technical Lead Manager – UI SE - Equities Desktop Platform

ReactJS/Typescript SE – Market Intelligence team

Senior ReactJS/Typescript Lead SE – Macro Trading

Senior ReactJS/Typescript SE – Execution Technology

Senior Credit Strat/QR

Structured Credit QR

QR – Factor and Behavioral Modeling

Market Data Support Engineer

Portfolio Quant Analyst - CAT

QD Futures - medium frequency

Senior SE – Distributed Compute Engineer

Senior/Lead Reference Data SE – Data Fabric

Reliability Engineering – SE (language agnostic)

Senior C++ SE – HFT Experience

Python QD - trading, markets, market microstructure, risk

Senior Operations SE – Java/Python

Senior C++ SE – Electronic trading

Senior Java SE – Post Trade

Fixed Income Systematic QR/Trader

Senior Data Engineer – Alt Data

C++/Python SE – Systematic Macro

DevOps Engineer – CI/CD

QR Equity StatArb – Futures

QD Equity Derivatives – Python

ML Engineer – GenAI Technology

Full-stack Engineer – GenAI Technology

GenAI Adoption/Integration Engineer

SE/QD – Refining QR Code

Configuration Management Architect – Systems Engineering

HPC Compute/ML/Cloud Infra – Systems Engineering

Platform Specialist HPC – Systems Engineering

Platform Specialist ULL – Systems Engineering

Data Scientist – QR

AI/ML – QR

QR – low-latency trading

QR – medium frequency – Futures

Sell Side

I heard there’s a KDB SE role at Morgan Stanley…